One reason why students should complete the FAFSA even if they don’t think they’ll qualify for financial aid is because of the possibility of college work-study jobs. Work-study jobs require completion of the FAFSA and even if your EFC keeps you from receiving any federal grants, you could land a nice work-study job depending on which college you go to.

One reason why students should complete the FAFSA even if they don’t think they’ll qualify for financial aid is because of the possibility of college work-study jobs. Work-study jobs require completion of the FAFSA and even if your EFC keeps you from receiving any federal grants, you could land a nice work-study job depending on which college you go to.

Work-study Funding Needs Reform

The reason is that work-study funding is allocated to colleges based on an outdated federal formula. The amount of money colleges receive to distribute as work-study has nothing to do with the number of needy students on campus relative to other colleges. In fact, the formula includes the total cost of attendance as part of the calculations.

You see the issue here, right? This means that the more expensive the school, the more funding it should receive. A student with an EFC of $40,000 is needy at a college that charges $70,000 but not at her state university that only charges $25,000.

The formula actually includes a provision for a minimum funding level so that schools never receive less funding than the year before. So even if there are fewer students with need, the college still receives the same amount of funding. As funding is cut, these grandfathered schools receive funding while those with more needy students see their amount cut.

All of this is why students at some of the most expensive and oldest campuses are more likely to find work-study jobs than those at newer, public institutions.

Furthermore, not only are students more likely to qualify for work-study at private institutions, they are also more likely to find an actual job. Remember, just because students are eligible for work-study jobs, doesn’t mean they’ll actually find one. And chances are, the amount earned isn’t by itself going to make college affordable. It will cover books but won’t come anywhere close to covering living expenses.

A work-study Job isn’t Going to Pay for College

For private four-year colleges with at least 500 full-time undergraduates, the average on-campus work-study disbursement was $1,463. The average for public institutions was $1,981.

While the average work-study disbursement is lower for private colleges, more students receive them. Almost 14% of students at private colleges received work-study while only 3.6% at public schools did.

In both cases, these numbers are significantly lower than the percentage of undergraduates receiving Pell Grants. You would think that Pell Grant recipients would be the bulk of work-study students but that’s not the case. According to the Washington Monthly, “only 43 percent of students who receive work study meet the federal definition of financial need as determined by whether they also receive Pell Grants.” Good news for those who don’t qualify but can use a job to help off-set expenses.

Some Colleges Have a Lot More Work-study Jobs Available Than Others

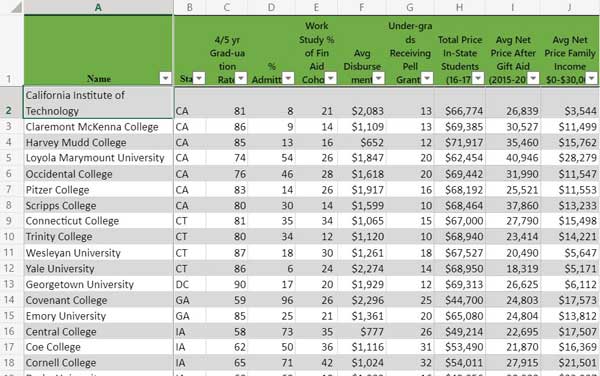

So which colleges are students more likely to qualify for work-study even if they don’t manage to get a Pell Grant? Well, I took some liberties with mixing data sets that no professional statistician would do and came up with 130 colleges. These are schools where the number of students receiving work-study disbursements as a percentage of the school’s financial aid cohort is larger than the percentage of undergraduates receiving Pell Grants. (The work-study information is from the Title IV Volume Reports and the other from IPEDS. If you don’t like mixing and matching, don’t use the list.) The list of schools is below.

Of the 130 colleges on the list, a third have acceptance rates of 30% or less. Around have half accept 50% or less. These are not easy schools to get into.

And if you’ve been paying attention, you won’t be surprised that these are some of the most expensive schools to attend. A total of 113 charge more than $50,000 a year to attend, 76 charge more than $60,000.

Now while some of these schools claim to meet 100% of student need, 33 still have an average net price of over $20,000 for students with family incomes of less than $30,000. A total of 98 had an average of $10,000 or more for the lowest income group.

Most of the schools had an average disbursement lower than $1,463 for private colleges in general. However, it’s not possible to tell if this is because of the number of hours students worked or the amount of their own funds institutions contributed in wages. For example, Yale had a total 1,335 recipients for an average of $2,274 while Tufts had 1,345 for a $1,271 average. In either case, this isn’t a “pay for school as you go” amount of money.