In case you’ve been in a coma and haven’t heard, there is a student loan crisis. According to the Federal Reserve Bank of New York, the total student loan debt of $1.46 billion exceeds that of consumer credit card debt. Apparently, students are borrowing too much to pay for college. Of course, you could argue that maybe they’re not borrowing too much, they just don’t have jobs that will allow them to make their loan payments. Either way, it doesn’t change the fact that students are often borrowing more than they can reasonably repay.

In case you’ve been in a coma and haven’t heard, there is a student loan crisis. According to the Federal Reserve Bank of New York, the total student loan debt of $1.46 billion exceeds that of consumer credit card debt. Apparently, students are borrowing too much to pay for college. Of course, you could argue that maybe they’re not borrowing too much, they just don’t have jobs that will allow them to make their loan payments. Either way, it doesn’t change the fact that students are often borrowing more than they can reasonably repay.

How Much to Borrow

The truth of the matter is that individual students have the ability to decide how much money to borrow. They also have the ability to decide what kind of money to borrow. This means that they need to understand the difference between private and federal loans. It sucks having to make a grown-up decision at 18 that could cost them $100,000s, but that’s college admissions today.

Actually, in most cases they don’t really to know much more than that they shouldn’t be taking out private loans. Given that virtually everyone qualifies for unsubsidized Federal Direct loans which have a maximum accumulated limit of $31,000, no one should be borrowing more than that. If you need to borrow more than that, you probably shouldn’t be going to the school.

Disadvantages of Private Loans

Even if private loans offer the possibility of lower interest rates, for the vast majority they are going to have higher interest rates and may require repayment to start while still attending school. They generally don’t offer forbearance or deferment options. Nor can students take advantage of consolidation programs, extended repayment plans, or government repayment programs that cap monthly payments based on your income.

While it’s certainly possible to find yourself with financial problems taking out federal loans, taking out private loans makes it much more likely. The simple solution is to apply to schools where you won’t need to take out a private loan. And yes, at some schools students are more likely to have private loans than at others.

Private Loans Now Mean Debt Later

The Integrated Post-Secondary Education Data System (IPEDS) reports the percentage of freshman who take out non-federal loans and the average amount. Non-federal loans can include institutional loans as well as private loans. Unfortunately, it’s not possible to tell what percentage of loans are private versus institution. Furthermore, it’s possible that institutional loans offer better terms than federal loans but we just don’t know.

If you’re considering a school with a high percentage of students with non-federal loans, be sure to take a close look at the school’s financial aid policies. Even if a college advertises that 95% of students receive institutional aid, that doesn’t necessarily mean it’s affordable. Students can still be significantly gapped leaving students looking for ways to make-up the difference. Don’t put yourself in a situation where the only way you can attend college is by taking out a private loan.

Colleges Where Students Have the Most Debt

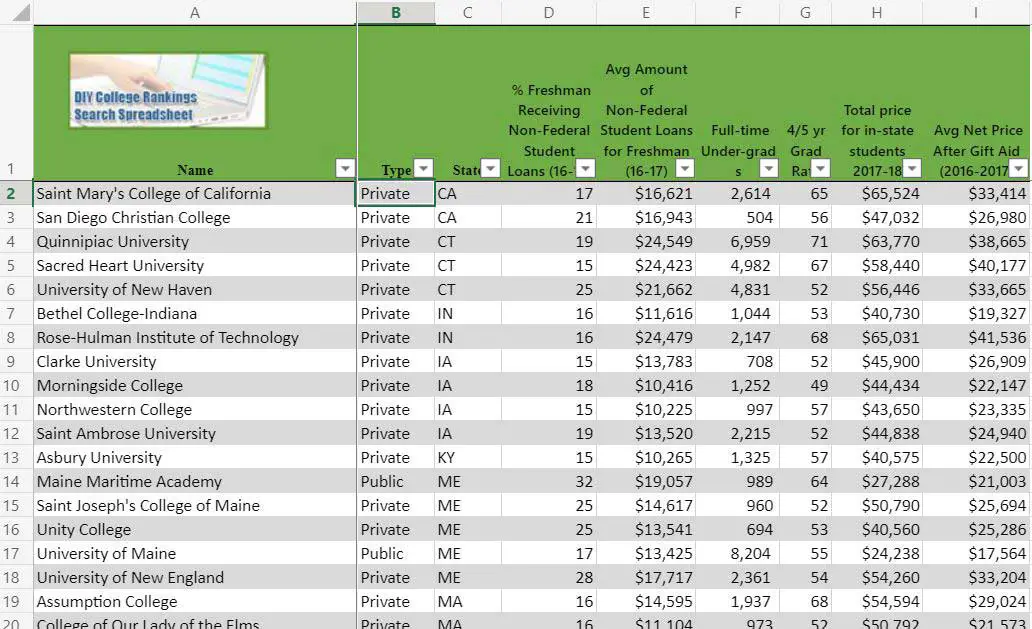

The table below lists the 124 50-50 schools where 15% or more of freshman have non-federal loans greater than $10,000. When considering the amounts, remember even a relatively low amount such as $3,000 will add $12,000 in debt over four years. And chances are that’s on top of existing federal loans. Finally, these students are taking out these loans as freshman–what will they do for the following three years?

Nearly a quarter of the schools are public institutions. At over a third of the schools, 20% or more of freshman are receiving non-federal loans. Eleven of the schools have loan averages over $20,000. Five colleges fall in both categories.

Pennsylvania has the most colleges on the list with 35 including 12 public schools. Massachusetts is a distant second with 18 colleges. Minnesota came in third with 14. Ultimately, the colleges where students have the most debt can be found in only 20 of the 47 states with 50-50 colleges.

As usual, the five-year graduation rate is used for public institutions and the four-year rate for private schools. All of this information and more can be found in the DIY College Rankings Spreadsheet.