Given that paying for a college education now rivals buying a house, it isn’t surprising the New York Fed reports that “Balances of student loans have eclipsed both auto loans and credit cards, making student loan debt the largest form of consumer debt outside of mortgages.” Faced with limited financial aid and the prospect of the equivalent of a mortgage payment upon graduating from college, families can’t help but ask if “college is worth it?”

Given that paying for a college education now rivals buying a house, it isn’t surprising the New York Fed reports that “Balances of student loans have eclipsed both auto loans and credit cards, making student loan debt the largest form of consumer debt outside of mortgages.” Faced with limited financial aid and the prospect of the equivalent of a mortgage payment upon graduating from college, families can’t help but ask if “college is worth it?”

Naturally, the question depends on which college you’re talking about. In our Paying for College 101 Facebook Group, I’ve seen a lot of people agonizing over choosing a school with a “better” program versus a less reputable school but with a cheaper price tag. How do you decide the value of reputation, access, or specific programs?

How Exactly Do You Calculate Value?

Unfortunately, the colleges really aren’t interested in making the decision any easier by providing things like employment numbers so that families can compare schools. Because, of course, families couldn’t be trusted to use the numbers to compare apples to apples or something, blah, blah, blah….

Yes, call me a skeptic concerning their motives.

We are starting to get some information on salaries through sources like College Scorecard. However, it is difficult to make meaningful comparisons since you really don’t know the distribution of the majors for the degrees awarded or what field the graduates are working in.

You do have some rankings that are making attempts to look at Return on Investment (ROI) in terms of average salaries and average net price. However, as long as engineering schools dominate such rankings, I think they have limited value. After all, we need teachers too.

3 Year Student Loan Default Rates

So I’m offering one possible data point for college comparison consideration–student loan default rates. The basic premise is it doesn’t matter how much you are getting paid if it’s enough to pay for the loans. There’s no automatic award for graduating a lot of highly paid engineers.

Now there are all kinds of issues associated with the default rate. The rate reported by the department of education is only for after 3 years and only for federal loans. There are plenty of other concerns you learn more about here, here, here, and here.

Yet, despite these concerns, I think it’s worthwhile to take a look at the student loan default rate for colleges. If the average default rate for a 4-year public university is 7.38%, and you’re considering a school with a rate over 15%, you might do a little more research before signing for a student loan.

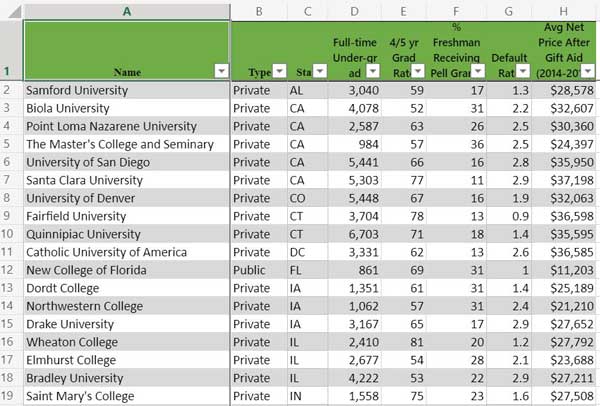

Among the 50-50 colleges, the average student loan default rate for private schools was 4.6% and public was 5.8%, both below the national averages. Going with the premise that the lower the rate, the better, I listed below all 50-50 colleges with a default rate of less than 3.0%.

There are 94 colleges on the list, 13 public and 81 private. There are located in 31 states, with Pennsylvania having the most with 9, followed by New York with 8 and Wisconsin 6. Among the private colleges, the average net price ranges from a low of over $14,000 to a high of over $40,000. The range for public universities is between $11,000 and $22,000.

Keep in mind, this is only for the Federal Direct Loan Program. It doesn’t include PLUS or private loans. As usual, the 4-year graduation rate is used for private schools and the 5-year rate for public. The DIY College Rankings Spreadsheet includes information on private and PLUS loans as well federal loans.

50-50 Colleges with Lowest Student Loan Default Rates