When talking to people about paying for college, one of my mantras is that you can’t get money from a college you’ve never applied to. Well, that’s changing with a new app called TuitionFit. TuitionFit is an absolute game changer in the college money arena and every family needs to know about it. Because if you use TuitionFit, you just could get money from a college you’ve never applied to.

Families are told not to avoid private colleges and universities because of their high sticker prices. The fact is that very few people pay the actual sticker price. This includes families in the highest income category since most private colleges provide financial aid for high income families in the form of tuition discounting more commonly known as “

Families are told not to avoid private colleges and universities because of their high sticker prices. The fact is that very few people pay the actual sticker price. This includes families in the highest income category since most private colleges provide financial aid for high income families in the form of tuition discounting more commonly known as “

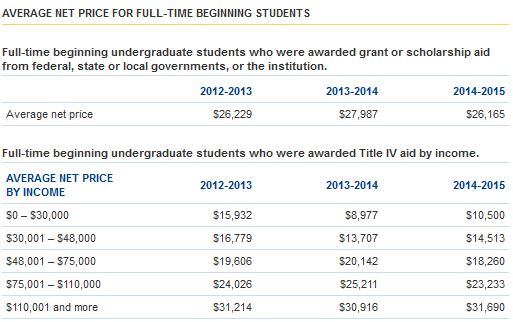

(Updated for 2019) Robert J. Kibbee, the former Chancellor of City University New York, observed “Over the years, we have come to identify quality in a college not by whom it serves but by how many students it excludes. Let us not be a sacred priesthood protecting the temple, but rather the fulfillers of dreams.” And if the dreams fulfilled aren’t going to be determined by family income, colleges are going to need to provide substantial financial aid to the neediest students.

(Updated for 2019) Robert J. Kibbee, the former Chancellor of City University New York, observed “Over the years, we have come to identify quality in a college not by whom it serves but by how many students it excludes. Let us not be a sacred priesthood protecting the temple, but rather the fulfillers of dreams.” And if the dreams fulfilled aren’t going to be determined by family income, colleges are going to need to provide substantial financial aid to the neediest students.

Given that very few private colleges meet 100% of financial need, the cheapest option for most low-income students will be one of their state’s public universities. There will always be some low-income students that will have their full need met at private colleges, but they will be the exception. The majority will find themselves “gapped” and forced to consider private loans to make up the difference.

Given that very few private colleges meet 100% of financial need, the cheapest option for most low-income students will be one of their state’s public universities. There will always be some low-income students that will have their full need met at private colleges, but they will be the exception. The majority will find themselves “gapped” and forced to consider private loans to make up the difference.

(The following has been updated for 2019.) Merit scholarships from colleges aren’t simply a way for schools to reward students for accomplishments, it’s part of the supply and demand of paying for college. Colleges use

(The following has been updated for 2019.) Merit scholarships from colleges aren’t simply a way for schools to reward students for accomplishments, it’s part of the supply and demand of paying for college. Colleges use

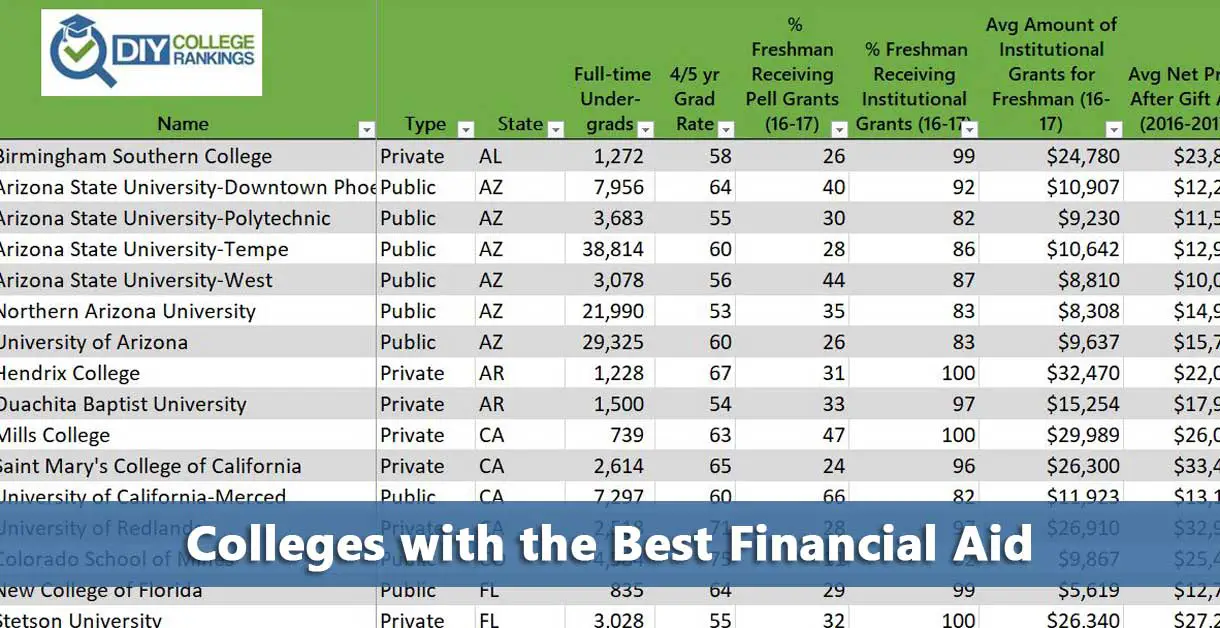

The list of

The list of

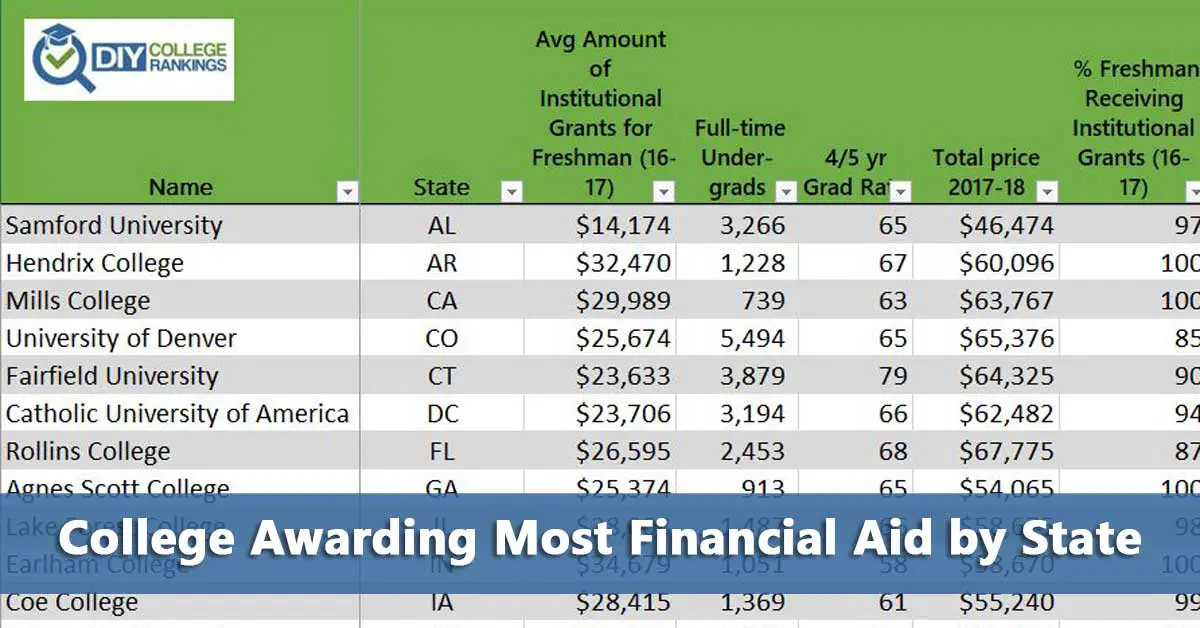

If you knew that the average amount of financial aid a college awarded freshmen was $25,000, would you consider it? With the cost of four years of college ranging from $100,000 to over a quarter of a million dollars, why wouldn’t you? I’m not saying you have to apply to the college, I’m just saying give it a look over because chances are it’s one that wasn’t on your radar. The table below lists all

If you knew that the average amount of financial aid a college awarded freshmen was $25,000, would you consider it? With the cost of four years of college ranging from $100,000 to over a quarter of a million dollars, why wouldn’t you? I’m not saying you have to apply to the college, I’m just saying give it a look over because chances are it’s one that wasn’t on your radar. The table below lists all