When I went to college, back in the 80’s, my Pell Grant covered my tuition. My parents were usually able to help pay for books and my student loans and part-time jobs paid for room and board. Thanks to financial aid, I was able to graduate from an honors program at my state flagship university in four years.

When I went to college, back in the 80’s, my Pell Grant covered my tuition. My parents were usually able to help pay for books and my student loans and part-time jobs paid for room and board. Thanks to financial aid, I was able to graduate from an honors program at my state flagship university in four years.

How many people can do that today?

Today, there aren’t that many schools out there where the Pell Grant would cover the cost of tuition. Out of almost 1,600 four-year institutions in the Integrated Postsecondary Education Data System (IPEDS) with 500 or more full-time undergraduates, in 2014-15 only 96 had published tuition and fees that are lower than the $5,157 maximum Pell Grant. There are 25 states with no schools where the tuition and fees are less than the Pell Grant.

Of course, financial aid has “evolved” since the 1980’s and a better way of looking at the situation might be to compare how much aid is awarded to students in the lowest income category compared to actual tuition and fees. According to IPEDS, at over 479 colleges (public and not-for-profit), students whose family net income was $30,000 or less had an average gift aid award greater than or equal to their published tuition and fees. That’s better than 96 but it’s still less than a third of all colleges.

Furthermore, tuition and fees doesn’t include living expenses, books, and transportation. If you assumed that students should be able to come up with $5,000 themselves by working, then students at only 11 colleges in the lowest income category received enough gift aid to cover their total cost of attendance.

Public institutions have traditionally been the way anyone could get a good education. However, out of 553 schools with information, students at 133 had average gift awards at least $500 less than the cost of just their tuition and fees. In eleven states, 50% or more of freshman with family incomes of $30,000 or less are attending public institutions where the average award doesn’t cover their tuition and fees.

If education is the great equalizer, the one way anyone can get ahead, it has to be affordable. Today, even middle class families are struggling to pay for college. You often hear that only the rich and poor can afford to go to college. Don’t be so sure about the poor part.

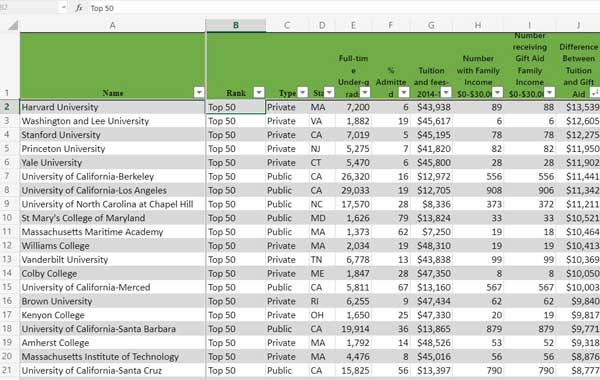

The following table shows the top 50 and bottom 50 public and private institutions in terms of the difference between the published tuition and fees and the average amount of aid awarded to students in 0-$30,000 family income group. The data are based on the 2014-15 school year.

Colleges for Financial Aid for Students with

Family Incomes of $30,000 or Less

4 thoughts on “Financial Aid for Low Income Students-No Cause for Envy”