In Part Two of How to Find Merit Scholarships, I said that you need to look at the numbers on institutional aid and non-federal loans to get an idea of which schools are more likely to give out merit money. Now we’ll look at some examples to see how it works.

In Part Two of How to Find Merit Scholarships, I said that you need to look at the numbers on institutional aid and non-federal loans to get an idea of which schools are more likely to give out merit money. Now we’ll look at some examples to see how it works.

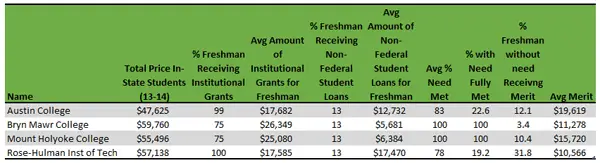

We’ll take four schools on the list that have 13% of freshman receiving non-federal loans. I’m including information available only through the Common Data Set (CDS) as a way of confirming how to interpret the IPEDS data (learn more at the College Data Workshop).

I would prefer to be able to just download the CDS data and use it, but that’s not possible. Instead, you can look up the information through Big Future or College Data websites but both have significant limitations in searching their data. So I use IPEDS data and check with CDS when something doesn’t make sense.

In the following table, that last four columns are all data from the Common Data Set for freshman.

Let’s start comparing.

Mount Holyoke and Bryn Mawr have the lowest average of non-federal loans, almost half the next nearest schools. At both schools, 75% of freshman are receiving institutional grants of $25,000 or more. $25,000 marks the lower range of institutional aid for schools emphasizing meeting financial need which in this case is confirmed by the common data set.

Normally when you have a high average for institutional grants, the school isn’t likely to be giving merit aid. However, according to CDS data, both colleges are providing some merit aid, although fewer receive such aid at Bryn Mawr than at Mount Holyoke. Doesn’t this blow the theory? No. Both are all female schools which you would expect to still have to offer some incentives to get the students they want.

Why is Mount Holyoke a bit more generous than Bryn Mawr? Maybe because Bryn Mawr ranked 27th in US News College Rankings and Mount Holyoke 41?

Let’s take a look at Rose-Hulman and Austin college. Both have almost an identical average percentage of freshman receiving institutional grants for a similar average of around $17,500. So which is a better bet for merit aid? Based on the Total Price and the average amount of non-federal loans for freshman, chances are that Austin College might be the better option.

Austin College costs $10,000 less than Rose-Hulman yet students are receiving the same average institutional grant. The $17,500 will cover more of the costs at Austin College than at Rose-Hulman.

The Common Data shows that the average non-need merit award at Rose-Hulman was $10,566 while the average at Austin College was just over $19,000. Of course, freshmen are much more likely to receive non-merit awards at Rose-Hulman than at Austin College. But given the difference in price, it might still be cheaper to attend Austin College even with the merit award from Rose-Hulman.

None of these numbers mean much by themselves. They really only begin to mean something when you start comparing institutions. When looking for colleges for my son, I came up with the following “rules of thumb” when comparing the schools:

- Combination Low Percent of Freshman Receiving Institutional Grants with High Average Amount of Institutional Grants=meeting almost all or all financial need, little to no merit aid

- Large Percentage of Freshman Receiving non-Federal Loans and Lower Average on Non-federal Loans (~$5,000)=meeting a higher percentage of financial need while offering merit aid

- Higher percentage of Freshman receiving non-federal loans and higher average on non-Federal loans means that gapping is probably occurring while providing just enough incentive for non-need students to attend.

Of course, we’re also dealing with averages. That means that you may end up with substantially more or less than the given numbers which was the case with my son. Ultimately won’t know until you apply. However, you can increase your chances for receiving merit money if you take the time to follow the money before you apply to any school.

If you’ve found this series on “How to Find Merit Scholarships” useful, you can learn even move on how to target colleges by taking the Using the DIY College Rankings Spreadsheet Class. The next class starts on February 12th-register now!

Michelle, once you have a target school or schools and then when trying to predict merit aid, I have using the net price calculator from the school’s web site. Do you feel this is a good way to estimate merit aid?

It depends on the calculator. If it specifically includes merit aid, it’s probably an acceptable estimate. I hear people complaining about the calculators not coming close to their estimated EFC but haven’t heard a lot about not getting the estimated merit aid. You can always check it against the Common Data set for average amount of non-need based aid. Remember, ultimately, the school can always fall back on that it is an “estimate.”