Anyone who pays attention to the media has heard the alarming reports about student debt. In the United States student loan debt is about $1.7 trillion which exceeds the total credit card balance. Scary numbers. You would expect the question, “How much should I borrow for college?” to be the question that all students and their families are asking. But I don’t’ think that’s actually the case. Let me explain why.

Anyone who pays attention to the media has heard the alarming reports about student debt. In the United States student loan debt is about $1.7 trillion which exceeds the total credit card balance. Scary numbers. You would expect the question, “How much should I borrow for college?” to be the question that all students and their families are asking. But I don’t’ think that’s actually the case. Let me explain why.

There are two basic problems with student loans today.

Based on media reports, it seems that people are borrowing too much money to pay for college.

Because of this, students are afraid to borrow any money to pay for college which can result in significantly less earnings over the course of a lifetime.

You Need to Ask How Much Before You Start Applying to Colleges

Both of these problems originated from NOT asking how much should students borrow. It’s as if the scary numbers being reported are keeping families from looking at any numbers. Instead, they latch onto the belief that all debt is bad or that a degree from a prestigious school is worth any debt so the numbers don’t matter.

But this is how the scary numbers start. You have students and families borrowing money to cover the cost of a college education believing that the degree, usually from “the right” school, will make the loans insignificant. It is only after graduation that they realize that a $40,000 annual salary isn’t going to wipe out $100,000 in debt. (By the way, only 6% of borrowers owe $100,000 or more in student loans-that should tell you something.)

If such students actually asked how much they should have borrowed, they were obviously given the wrong information.

Calculators Can Help Determine How Much Students Should Borrow

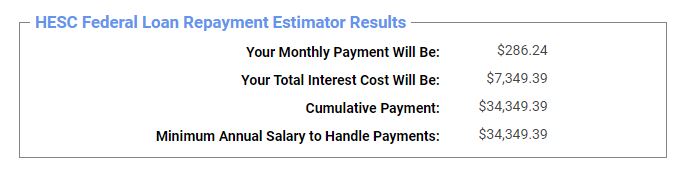

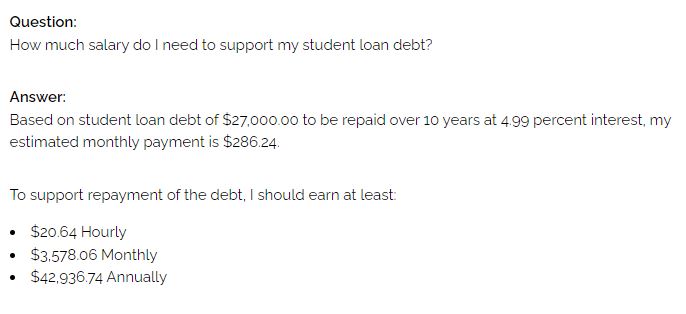

What they should have done is used a debt calculator such as the ones you can find at Mapping Your Future or New York State Higher Education Services Corporation. At both sites you can enter a loan amount and find out what the monthly payments will be. If you take out the maximum allowed for four years through the Direct Student Loan program, $27,000, you will owe around $300 a month, the same as a reasonable car payment-not a mortgage payment.

The Mapping Your Future calculator has an additional feature that lets you estimate how much of a salary you need to support a student loan. A $27,000 loan requires a $42,937 annual salary. This is within the average starting salary range of a college graduate. However, keep in mind, some will start much lower depending on major and region. And don’t forget that interest rates change. If interest rates go above six percent, your salary will need to increase by around $2,000.

The Mapping Your Future calculator has an additional feature that lets you estimate how much of a salary you need to support a student loan. A $27,000 loan requires a $42,937 annual salary. This is within the average starting salary range of a college graduate. However, keep in mind, some will start much lower depending on major and region. And don’t forget that interest rates change. If interest rates go above six percent, your salary will need to increase by around $2,000.

Mapping Your Future Debt Calculator Results

Mapping Your Future also has an option to enter your expected salary and it will calculate the maximum you should borrow. A projected salary of $80,000 means that you can borrow around $50,000. However, that’s using the federal interest rate for Direct Loans. To borrow more than $27,000, you’re going to have to do so at a higher rate. If you increase the rate to 6.54% you can only borrow just under $47,000. Remember, that’s for all four years, not per year.

Back to the problem of students being afraid to borrow any money to pay for college.

What’s Worse Than Debt?

Let me start by saying graduating from college debt free is wonderful but not always possible or the best option. There are many students who will not graduate from college because they take off a semester to work to save more money for college and never return or end up taking fewer and fewer classes so that they can work more to pay for college.

Now they have debt, no degree, and are making less money than had they graduated. This explains how borrowers can be struggling to make payments on even relatively small student loans. According the Federal Reserve Bank of New York, “the highest default rates, at nearly 34 percent, are among the borrowers who owe less than $5,000.” Maybe these students should borrow some more if it would allow them to graduate and get a better job.

There are people who graduate from college going part-time over six or eight years but they are the exception rather than the rule.

There are also people who successfully start at a community college and transfer to a four-year institution to complete their degree to save money. Such students are increasingly more successful than they had been in the past as states simplify articulation/transfer agreements between institutions. However, it takes a very focused student to manage the transfer process. Overall, students are still less likely to graduate if they start at a two-year college than at a four-year institution.

The fact is that students are more likely to graduate if they attend a four-year college with a significant proportion of residential students. Saving money by living at home and commuting, particularly for the freshman year, can make it less likely to complete your degree. (This is not necessarily the case for first generation students or students from certain ethnic backgrounds.)

Taking out Federal Direct loans that will allow continuity in your education or allow you to transfer to a non-commuter campus after finishing at a community college is a reasonable option.

Yet many students are unwilling to even ask how much they can borrow even though their increased earnings as college graduates would justify some debt.

I’m not saying that working your way through college or starting off at a community college and avoiding student loans is a bad thing. I know several people who have done so successfully including my mother. The point is that if a student loan will help you get through college, it is something to consider without panicking.

There’s a Reason Why There is a Limit to Federal Loans

So how much should students borrow for college? Given the average starting salary for college graduates, it looks like the four-year maximum allowed under the unsubsidized Federal Direct loans, $27,000, is the reasonable maximum amount.

Families need to be aware that many colleges use Direct loans as part of your financial aid package. In such situations you can’t use the loan money to pay for your part of the Expected Family Contribution (EFC). This is why, especially if you’re applying to private colleges, you want to go to colleges that don’t use loans to meet your demonstrated financial need since there is a good chance you’ll need the loan to cover your EFC.

Colleges will offer parent loans (PLUS) to cover the difference but if you can’t afford a college without taking out a PLUS or private loan, you should consider a different college.

One final consideration. There is something worse than borrowing too much to go to college–borrowing too much to go to college and then not graduating. So if you are borrowing to go to college, make sure it’s one where you have a decent chance of graduating from.

8 thoughts on “How Much Should Students Borrow for College?”